She’s Seen It All

Taking out a loan can be a frustrating, nerve-wracking, and even scary experience for the average borrower. It can be just as daunting for the bankers responsible for helping borrowers apply for those loans. You never really know who’s going to walk into your office on any given day. Are they even going to qualify for the loan they’re after?

The reality is that more often than not, it’s actually just a run-of-the-mill process. The borrower is looking to buy a house, get a new car, take out a personal loan to consolidate debt, or maybe even start that business they’ve been dreaming about for years. They apply, get approved, and eventually get their money. But, that’s not always the case. Check out these bankers’ stories about the strangest reasons they’ve been asked for loans…

A Generous Offer

Oh, where to start? I had one customer who wanted to borrow funds to start a theme park based around tents, nowhere near any major city, with projections that between 600,000 and 800,000 people would visit per year. Another customer wanted to secure a loan using his ex-wife’s house as collateral on the basis that he had paid for it, so it was really “his money” anyway.

A third customer wanted to borrow funds to start a snow manufacturing and delivery business for Christmas. Mind you, this was in rural Australia, where Christmas happens in the summer and it’s rarely lower than 30 degrees Celsius. The fourth customer wanted to buy a Range Rover, while on welfare, with a non-payment period because she “could use the car to meet someone who could pay for it.” We’ll never know if that would have worked out for her. Reddit user: CaelusBell

There’s Got To Be An Easier Way

I had a guy come in once and start being rude to the greeter, who then referred him over to me. This guy was in his fifties, and looked like he lived in his car. He proceeded to tell me that he needed five thousand dollars to fly to Washington State, to solve the murder of his son. He didn’t want to do any paperwork, or show an ID, because he was a “dealer” and thought that would hurt his chances.

He wanted to leave ten thousand dollars worth of “product” with us as collateral for the five grand—which he wanted in cash. He assured me he was a professional and that, in the 26 years he’d been in this line of work, he’d only been arrested twice. Though he mentioned he did just get out of jail on “unrelated” charges. I had to decline his generous and exciting proposal because, ya know, everything. Reddit user: [redacted]

He Wanted To Establish Authority

Not a banker, but I’m a pawnbroker. I have this frequent customer, who happens to be a gambling addict. She went to the store and bought a brand new thousand dollar TV on her credit card. She then brings it to my shop and pawns it for about 20% of what she just paid for it. Next, she goes to the local Indian casino, wins a bunch of money, comes back, and pays back what she owes me for the TV loan.

Finally, she returns the TV to the store so she doesn’t have to pay the interest rates for the purchase on her card. A long, crazy process to get extra gambling cash. I’m not even sure it’s cheaper for her to do it that way than it would be to just get a cash advance on her card. She has done that about five times—we see no reason not to do it—but, I’m sure there have to be more efficient ways to spend your money. Reddit user: RRettig

He Felt Pressured Into It

I once had a 20-something-year-old dude, who’d just started out on a career as “area sales manager” for some multi-level marketing scheme, and wanted to buy a Mercedes to “adequately represent his position and his profession.” He was looking to borrow somewhere in the range of €60k—about $68k. He even knew the “best color” to make a statement, and non-verbally establish his authority. Apparently that color is blue.

Needless to say, the loan was denied. But he asked that we keep tabs on his accounts, so that we’d be able to “extend him an offer” once we saw that he had the funds. So, I’d check it periodically for the big bucks he claimed would be rolling in soon. It wasn’t even two months before he was on welfare. Reddit user: [redacted]

If His Rap Career Ever Took Off

This was more of a complaint after taking the loan. He wanted us to write off the whole £15k debt, on the grounds that he felt pressured into taking it. But, it wasn’t even a pushy member of our staff trying to make a sale. It was a direct-mail offer. He claimed he received them so often that, “I just couldn’t take it anymore. So, I went down to the bank and took the stupid loan.” I looked at his account and, within two weeks of receiving the £15k, he had spent the entire lot on gambling sites.

Apparently, his plan was to take the £15k and turn it into a lot more, via the flawless method of online gambling. At first, I felt strangely satisfied writing my response letter—stating that it was clear that he’d done this knowing the potential risks. But, since then, I’ve thought about the guy a lot. He might have had a serious addiction. Imagine his desperation as he kept losing until the money was all gone. Imagine knowing you’re now paying £300 a month for the next five years as a result. In the end, he did it to himself, but it’s still sad. Reddit user: kitjen

She Needed A Bell Pepper

This guy wanted £10k to “buy a rap studio.” Note that I didn’t say he wanted to start his own studio, but to buy one. When pressed, it turned out he didn’t have a particular one in mind, and he had no idea how or where to go about buying one. The Rap Studio Store, I assume. He was also the geekiest, scrawny little white guy in a small English town, yet he tried to act like he was from Compton. I knew the guy. He’d never left the UK.

He had no job, no savings, and, therefore, no money to pay back the loan—but he promised to pay back £50k when his rap career took off. Not sure how he’d gotten to £50k when we’d only been talking about £10k. Interest rates aren’t quite that high. Apparently, this was a no-brainer for him. I couldn’t help but agree. Just not for the same reason. Reddit user: TheBestBigAl

A Chainsaw Loan

I used to be in consumer lending for a credit union call center. A lady called in once asking for a personal loan. Our policy was to ask what the funds were going to be used for. This is to prevent fraud, first and foremost, but also to make sure the customer has a valid reason for the loan. When I asked, she said, “I need to buy a bell pepper for dinner.”

I was sure I misheard her, so I asked her to explain. She said, “I am trying to make dinner and it requires a bell pepper. I need the loan to get the bell pepper.” I told her that there was no bank, anywhere, who would give her a loan for that little. But, if she needed something like a payday loan to get groceries, there were other places that could help her. Nope. She just wanted one single bell pepper. She had an account with us. She could definitely afford to buy one bell pepper. Reddit user: wgr9381

She Was Convinced He Was Legit

One morning, a heavily tattooed guy wearing a white tank top and jean shorts walked into my bank. He reeked of alcohol. He walked straight up to my desk, sat down, and told me he wanted a “chainsaw loan.” Not a loan to purchase a chainsaw, but a chainsaw loan. He literally wanted the bank to purchase a chainsaw and loan it to him. I explained that chainsaw loans don’t exist, but that we could offer him a credit card, or a personal loan, so he could purchase a chainsaw.

He then admitted to me that he had terrible credit, and wouldn’t qualify for a card or a personal loan. He said he needed to use the chainsaw as collateral to be able to secure the loan, because his credit was so bad. So, his whole plan was to get us to loan him an actual chainsaw that he’d then use as collateral for a loan to buy a chainsaw. Can’t make this stuff up. Reddit user: Ecj7c5

He Was Proud Of It

The client wanted a $60k loan to send funds to her “overseas US boyfriend,” who she had never met. He was going to pay her back as soon as he got his discharge from the Marine Corps. Supposedly, there’d been a mix up with his papers, and they were trying to deploy him to Afghanistan when he was supposed to be retiring. Somehow, this had led to all of his accounts being frozen.

After a lot of back and forth between me and my manager, the bank allowed her to take out the loan. I often wonder about her, and hope that it was not a complete scam. I know she definitely sent him the money because, when she came to get the loan, she had already sent him over $50k. I couldn’t get a clear answer about why he needed so much money, other than that he was trying to “sort things out, so he can come be with me.”

It was an unusual situation and, due to the Responsible Lending Act, I was very apprehensive about doing the loan. It only got cleared after we got the client to declare, in writing, that she fully understood the risks, etc. She was adamant that he was legit. Reddit user: thestupidhelmet

He Needed To Deliver In Two Weeks

I once had a man in his early 20s take out a $60k loan to pay for traffic violations he’d racked up over a nine-month period. Upon further probing, he admitted that he spends around $20-50k per year on speeding tickets and reckless driving citations. Honestly, I have no idea what you have to be doing to have that many traffic violations.

What completely floored and confused me the most was the fact that he seemed almost proud of this “accomplishment.” He actually had a decent credit history, so he did get the loan. I made a note of his name, though, and Googled him. Turns out he simply felt like literally any part of the road was somewhere he could park. Sideways. Diagonal. On the actual road during traffic. I’m still at a total loss on this one. Reddit user: [redacted]

It Seemed Like A Great Idea

A guy who sold steaks—the ones who go door-to-door offering subscription plans and “great” discounts—had used all of his customers’ money on his own expenses. Bills, rent, and most likely partying. He was supposed to deliver $30,000 worth of steaks in two weeks’ time. Steaks, just so you know, that his customers had already paid for in full.

He wanted a loan to pay for the steaks so he could deliver them on time. Spoiler alert: his credit was not fantastic, so he didn’t get the loan. Obviously, he wasn’t a happy camper when we told him it wasn’t going to happen. He left me voicemails for the next two months that consisted of him saying “hello” repeatedly, or cursing. Reddit user: Scottrunz

He Called The BBB

I used to go out with a girl whose mother was a rep for a high interest, doorstep loan company—they’re a kind of home equity loan that you can get approved for in person, at home, and figure out the details later. The customers were generally poor, and should not be getting involved in those kinds of loans, but she didn’t care. She sold the loans, and encouraged them to keep taking out more loans.

She had one customer who was mentally handicapped. He never worked, hardly went out, lived alone, and had no real interests—mostly just sitting around watching TV, and doing housework. He seemed content with it. He used to get a loan, make the payments, and, when it was finished, he’d take out another. One day she finally asked him what he was doing with the loans. His answer was that he put the money in his savings account. He thought that if he put in the £200 he’d borrowed, by the time the loan was paid back, he might have £201.

In his eyes it was a genius scheme to make money. The fact that he had paid around £60 in interest on the loan was lost on him. Obviously, she never bothered to explain his error. Reddit user: gnorty

A Fuel-Proof Business Plan

We had this customer for about six months who had a serious alcohol problem. When he came to open his account, he stank so badly of liquor that I had to hold my breath. Fast forward six months: he was, predictably, an awful customer. Super-low credit score, and never held more than $50 in his account. He was over 40, and still received checks from his parents.

Anyway, his liver was about three years past due, if you know what I mean. Truly, I’ve never seen anyone’s eyes so yellow. He came in one day asking for a loan so that he could go to Mexico to get a liver transplant. When we declined—due to his horrendous credit history, and overall character—he called corporate and, apparently, the BBB, saying that we’d denied him a loan because he was alcoholic. Within a few days, we’d closed out all of his accounts. Reddit user: Corridizzle

He Already Had An Appraisal Done

I had three guys come in asking for a loan to buy gasoline. They wanted to buy a huge amount of gas, store it, and then resell it after the price went up. They even had charts with girls in bikinis on them—I think they thought they’d be speaking with a man. Well, okay, I know they thought they’d be speaking to a man. They all looked a little uncomfortable when they realized I, a woman, was the loan officer.

They kept explaining how both they, and the bank, would make thousands of dollars once gas prices skyrocketed. They talked in circles, going over their really bad math again and again. I couldn’t help but ask whether or not girls in bikinis were part of their business model. They didn’t know what a business model was. I declined their request for a loan to buy gasoline. Reddit user: NWC5790

I Just Couldn’t Do It

I’m not a banker, but I was a loan officer for a brief period in college. My buddy knew a guy who wanted to refinance his house to pull cash out to pay for a mail-order bride. So, being the industrious young man I was, I figured, “Why not?” It would, at the very least, be a hilarious story to tell my kids one day.

If you’re familiar with the refinancing process, you know that—in most situations—an appraisal is required to establish the value of the home. He said he’d already had one done. I remember my buddy telling me that his front yard was a mess. He tried to send us photoshopped pictures of the yard—just the yard. No interior images, and no appraisal report. I really don’t know why or how he thought that would work. We told him he’d “wasted his money,” and that we would order a new appraisal. The real appraisal showed his front yard to be a total mud pit. The house was no better.

He didn’t get his refi. Nor, I assume, did he get his mail-order bride. Reddit user: daredaki-sama

It’s Not Illegal If You Don’t Call It That

I had this guy come in and request a loan for what he called a “business opportunity” in Nigeria. I asked him if a prince was involved—couldn’t help myself—and he innocently said, “Well, yes! How did you know?” He went on to tell me he’d never met the people, but that this small investment of $10,000 could yield him millions in return. He even wanted to talk to my boss, and get the bank in on the deal.

He was pre-approved for a loan, and I’d have made a decent commission giving it to him. But, I just couldn’t. He was so innocent and trusting. He really believed that it was all legit. I told him to go online and read up on Nigerian scams and then, if he was still sure, to come back and we’d do the loan. He never came back. Reddit user: temporarypermanent

It’s Not For My Wedding Anymore

This one guy wanted a loan for $3k so he could send out money to other people, in the hopes that they would send him even more money in return. I said, “Sir, are you looking for a loan to start a pyramid scheme?” His response was, “Well, no. If you call it that, then it’s illegal. I just want to do nice things for people, and have equally nice people pay me money in return.”

Another favorite of mine was this person requesting a business credit card for a business that didn’t actually exist. She knew that a sole-proprietor business could apply for accounts and credit without filing business documents with the state. But what she didn’t know was that the business entity needed to have the owner’s full legal name as part of the business name. Or have a business name in general. Oh, and also, it needs to exist. It’s the little details that get you. Reddit user: ColeyPickles

Not Quite Sure What They Were Thinking

I work for a company that does business loans. This means we only fund businesses, not individuals. The purpose cannot be deemed for “personal use.” I’ve had numerous hilarious requests for loans that are just outright dumb. My favorite is one that is also the most painful. Dude says, “It’s for my wedding this weekend.” Our processor immediately denies the application. Then, he comes back the next week and actually says, “Hey, it’s not for my wedding anymore. Now it’s for payroll.”

I’ve also heard “I’m buying my wife a nose job,” “I want to get a Mustang,” and things like, “We’re building a pool.” The list goes on. One of the really sad ones was this guy who was closing his business permanently, but still needed capital to pay off the debts he’d accrued while still in business. Unfortunately, since they weren’t actual business debts, I couldn’t help him. Reddit user: ManWithYourPlan

A Scheme To Win The Lottery

I work for a credit union and take care of general account questions, as well as loan applications. I had a young woman in her early 20s ask for an $80 loan because she was strapped for cash, and wanted to go out with friends. The problem is that our loans were required to be a minimum of $500. She was insisting she only needed $80, not $500, and would pay it back when she got her financial aid. She eventually got upset with me, and hung up.

I had a call today with a woman who wanted to apply for a personal loan to pay off her credit card, and her son’s credit card. Both were held with us, and added up to about $28k in total. I told her that we won’t approve a personal loan to pay off existing loans with us. She was already over a month late on her payments. She insisted that I submit the application anyway, and let the underwriters decide. I did. They immediately denied it. Reddit user: Coffeecoffeecoffeexo

Hello Kitty

I work in commercial lending, and got called down to the branch one afternoon. This lady wanted a loan for $10,000 because she had a fool-proof way to win the lottery. When she told me this, I got frustrated. She was wasting my time, and the branch was supposed to screen clients before they were put in front of a loan officer.

Still, I decided to play along for a minute, and asked her to explain her method. She refused because, “If I tell you, you could do it before me, and win my money.” So, I told her I couldn’t lend her the money. I also told her that we were a commercial lender, and didn’t even work with individuals anyway, but, “Thanks for stopping by. I hope you win.” Reddit user: isamu009

She Just Wanted To Save The World

I used to be a personal banker in a small branch of a large bank. This branch was in a small town, and most of the people were fine. Occasionally, though, we would get some “interesting” people coming in. One of these people was a woman in her mid-twenties who came in with her father to get her first credit card. She seemed very excited about it, and her father was being very supportive. He kept saying things like, “You earned this, honey.” It seemed like a pretty big deal to them.

So, I ask what she’s planning on using the card for. She tells me that she wants it to pay for a Hello Kitty tattoo she has always wanted on her shoulder. The tattoo was going to cost almost $1,000, and she only had a few hundred dollars to her name. Unfortunately, her credit was awful and she didn’t get approved for the card. Plus, the card she was applying for had an interest rate of over 20%, so she’d have been paying that off forever. I wonder if she ever got that tattoo. Reddit user: dattatatta

It Never Occurred To Her

A woman wanted to borrow $5,000 to buy a machine that ionized water. This machine, according to some guy she met at church, could cure cancer and just about any other type of illness. Conveniently, he just so happened to be the one selling her the machine, as well. She thought of this guy as a modern day saint. I thought of him as—well, as something else.

She thought she could save the world. We—my colleagues and I—Googled the device, and it was so clearly a scam. Nothing more than a glorified water purifier. Plus, the “science” behind it was completely sketchy. But, she had very good credit, and it was an unsecured loan. We couldn’t tell her what she could do with the money. I hope she figured it out. Reddit user: Knitacular

He Was Arrested Immediately

I had an old lady trying to get a loan to “help” her tech support guy, who lives in India. She’d been “trying to send him money for a long time, but it always gets mixed up.” She had a long list of wire claims trying to get her money back from scammers, yet she was still trying to wire this guy money. He’d given her some long, complicated sob story about how his family was broke.

She “needed” to help this guy, but her money was tied up in the previously mentioned claims. It had never even occurred to her that the tech support guy was the scammer. It really made me angry to see a scam like this in action. We are allowed to explain that this is likely a scam, and to encourage the customer to report it; but, if they aren’t being abused or stolen from, the bank can only do so much. It’s their money, and their decision. Reddit user: heaven1lee

The Plan To Land A Millionaire

This one customer had just started a business. He already had investors, and planned to break into manufacturing—he’d purchased millions of dollars worth of real estate, warehouse space, equipment, etc. He requested a loan for “asbestos removal.” His paperwork and financials were solid, so the loan was approved. He then used the loan to pay a hitman to “handle” the husband of one of his executives. I’m assuming there was an affair.

Well, it turns out the hitman was an undercover cop. The customer was immediately arrested after handing over the cash, and served nine years in prison for conspiracy to commit murder. The bank I worked for agonized over every audit, inspection, and tiny issue for years afterward. I bet that building still has an asbestos problem. Reddit user: alliezoomzoom

In My Country…

This is not exactly a loan application scenario, but it’s similar. I used to work as a collector on Home Equity Line of Credit accounts. Also called HELOCs. They’re a type of loan that was super popular before the housing bubble burst, and they can be pretty predatory. In a HELOC the bank essentially gives you a line of credit that’s tied to the equity on your house. It can be a terrible idea for most people. It’s only really useful if you’re doing home improvements, or if you flip houses.

Since I worked these collection accounts, I’d be able to see all of the purchases someone had made on their line of credit, just like a credit card statement. It was always horrible to see what people were using it for. Typically things like shopping or restaurants. However, the most ridiculous thing I ever saw on someone’s account was a $300 monthly membership to one of those millionaire dating sites.

I broke protocol on that phone call, and asked about the charge. The woman explained that it was an investment on her part. She was going to land a millionaire, and that was going to fix all of her financial problems. She was in collections, after all. I think about her from time to time, and I hope it worked out. Reddit user: maeberry8

Over And Over

I work for a bank in Australia. I had an American woman, who already had one property with us, try to use the equity on her property to purchase another one. Problem was, she didn’t have enough monthly income to support the new loan to purchase the additional property. She whined at me that, “In America, as long as you have enough equity, they will give you the loan.”

I found it pretty funny that she was complaining about lending policy in Australia when her country caused the Global Financial Crisis by giving out home loans to people who couldn’t afford them. Also, I thought it was interesting that she also clearly didn’t know that no American bank was going to give her a new loan without adequate, provable income, either. At least, not anymore. Reddit user: [redacted]

That’s A Lot Of Extra Work

I had a customer who would come in every single day to work on a loan application. He was younger than me, probably about 22-ish. Every day we would have him meet with our personal banker, who, after a while, had his paperwork ready for him when he walked in, and they would submit it to our loans department. This was a process that they repeated once every week or so.

It takes about three days, give or take, to get a response from an underwriter for a loan request. He never got approved. So, one day, I asked the banker why they kept trying to get him a loan. He said that the guy “needed” it so he could fix his other bank accounts with other banks. The way he said it, though, I got the impression that the banker never actually submitted the applications. I don’t know why he never just told the guy to stop coming back. Reddit user: [redacted]

An Unstable Financial Situation

There was this one woman who wanted to buy tons of prepaid credit cards—like Visa gift cards—to pay off her phone bills. She had $2,000+ in phone bills, and she wanted to pay them with prepaid cards. I have no idea how she racked up that much in phone bills, or why her carrier just hadn’t cut her off. I also didn’t understand why she’d go through all that extra trouble just to pay the bill.

Well, my bank didn’t sell prepaid cards. She was furious when we told her. We asked her if she’d like to apply for a secured credit card to take care of her bills. She said, “NO.” So, we told her she could go to the pharmacy next door to buy them. She yelled at us about “dumb protocols” for a minute, and then asked to apply for a loan to buy the prepaid cards. Just—what? Reddit user: jimmym007

Addicted To The Slots

I had a 17-year-old girl call the credit union I work for once. She wanted to buy a house with her boyfriend. Also 17. They loved each other, and didn’t see why they should wait until they were “at least 18 before they lived together.” In most states, legally, you have to be at least 18 years old in order to buy a house. But, I was curious, so I started asking about her financial situation.

Well, predictably, they had no down payment. In fact, she also wanted to get a loan for a down payment. That’s a real thing you can do, but it’s not encouraged. Anyway, her income came from babysitting, and his income was from working odd jobs for the girl’s father. Her dad paid him in cash, under the table. In the end, I don’t think the boyfriend actually knew she was trying to buy them a house. Reddit user: KWGAudio

He Didn’t Even Have A Business Plan

A lot of elderly people are addicted to slot machines. They blow through their pension and social security checks, max out credit cards, and try to take out loans to support their habits. It’s sad. What’s worse is that a lot of financial institutions prey on that kind of behavior. As in: they will routinely approve small personal loans and, in some shadier situations, reverse mortgages—a type of mortgage that approves you based on how much longer you’re projected to live (it also means the bank owns your home when you die).

Anyway, casinos are no help, either. They’re pretty “good” about sending elderly people coupons for $5.00 of free play to get them through the doors. My dad got one of these coupons every month for years. He’d go in, play $5.00 on a penny slot until he lost it, and then head back home. He figured he was bored anyway, so might as well go in and gamble the free money on the off chance he ever won anything. But, he also never risked a dollar of his own, either. Reddit user: [redacted]

No Risk At All

I had a friend—well, more of an acquaintance—who sold “stuff” to me and my buddies. He was dealing in small quantities and wanted to step it up a bit, so he decided to go to his bank and ask for a $5,000 loan. He had no business plan; though, it probably would have had to be fake if he did have one.

When the banker asked him why he needed the money, he simply said he could “really use it.” Obviously, they refused the loan, and this kid started an argument. The details of that argument are a bit hazy. I don’t think he was sober at the time. After he told us this stupid story, he went on a rant about how the 1% and the “big banks” were trying to keep him down, and didn’t want him to succeed. What an idiot. Reddit user: [redacted]

Gaming The System

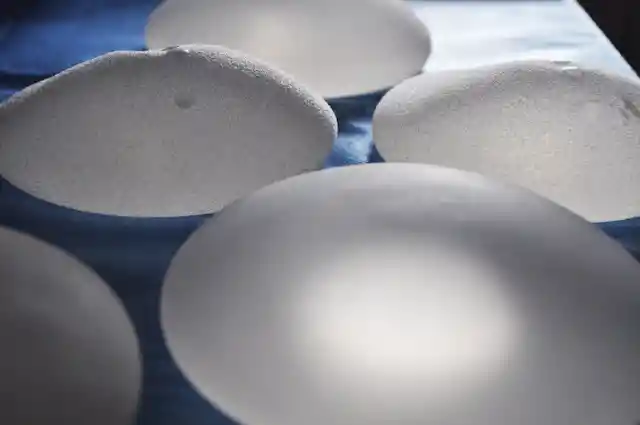

I’ve had a few people ask me for ridiculously small loans. Amounts of money that you can probably bum off a buddy. And, of course, some ask for massive loans amounts of millions of dollars, like it’s nothing to them. They never qualify for them, and don’t understand why we’re so worried about the risk of lending a guy who makes $28k/year three million dollars. But, there was this one girl who takes the cake.

She was 18 years old. She had no job and no assets. Literally nothing. She had a very matter-of-fact manner, and asked me if I was going to tell her parents she was there. I told her no. She then said that she wanted a loan to get implants. She said that she’d get a rich boyfriend once “the girls” were bigger, and then he’d pay the loan. Obviously I said no, and she wasn’t happy about it. She said, “No, I don’t think you understand, there’s no risk here, at all!” Reddit user: redacted

They Don’t Even Know They’re Being Manipulated

When I first started working at a bank, the first branch I worked in was in a fairly low-income part of town. We frequently had people coming in to apply for a loan for “things”. No one was ever much more specific than that. But, that wasn’t as surprising as the fact that most of them fully expected to walk in, sit with a banker for five minutes, and walk out with a check in hand.

The most infuriating scenario was a woman who requested a loan and, when we asked if she was employed, said that she didn’t have a job before going on a rant about how she made money by “gaming the system.” Turns out she was a foster parent to several special needs children, because “special kids get you more money.” I felt so sorry for those kids. She had no business caring for one special needs child, let alone several. Banking is a weird world. Reddit user: girlnextdoor480

A Used Mercedes Is More Cost Effective

I’m not a bank employee, but my mother is and she shares all her crazy stories from the credit union she works for. Not sure about other credit unions, but the one she works for is a not-for-profit company run by a board directors, all of whom are male. When they’re hiring or promoting, they purposely choose only highly emotional females.

My mom has been there for 10+ years, and isn’t even close to upper management. Yet other, less stable, women have gone from teller to loan manager to bank manager in as little as two years. Hiring only very emotional women has done a very important thing for the board: it’s given them people they can easily manipulate.

Whenever they need a loan, all they do is cry to the women in upper management with a story about how they had a tough week or whatever, and they immediately get approved for a loan—including very generous repayment terms. Sometimes they would even have these women simply “forgive” their debt entirely, if you can believe that.

Over the years, the board members have all received thousands of dollars in “loans” they never had to pay back. Former employees have been trying to report this credit union for years, but nothing ever gets done about it. To be honest, I’m not sure why my mom still works there. Reddit user: bankersonthrowaway

The Next Time I Have Money

This isn’t an absurd reason for a loan, but it was definitely absurd to expect to get a loan approved in this situation. I was a loan officer at the time and I primarily did mortgages, and loans for trucks or commercial equipment. This couple came in once who wanted to buy a home. I ran their credit and saw that their income was about $1,500 per month. Their car payments, combined, were over $800 per month. Apparently, they both thought a used Mercedes—instead of a brand new one—was the way to go on their income. The husband also had $50k in back child support from a previous marriage.

I actually could have gotten them a loan because it was 2006, back when anyone could get one. But I refused to do it, and explained their financial situation to them in great detail. I told them to go trade their cars in for something more economical, and also to try to find a second job for one or both of them. I never heard from them again. My best guess is because they found a loan officer who would do the loan. Reddit user: Jay_Highland

We Were The Bad Guys

This one guy wanted exactly ten pounds so he could take the train to his mate’s house, and watch the World Cup. He actually just expected me to put it straight in his account right then and there, with no fuss. He said he’d pay it back the next time he “had money.” Judging from his account balances, that wasn’t likely to be anytime soon.

I started to explain to him why that was not possible, and he interrupted to tell me we’d done it before. Out of curiosity, I checked his account history and found that, two days prior, he’d made a complaint about a transaction that had gone too slowly for his liking. To shut him up, a coworker of mine had given him the ten pound “sorry you’re mad” gift.

I told him that, unfortunately, I couldn’t loan him ten pounds. He asked to see my manager. She argued with him for over an hour. He only left when she pointed out that the match had been on for thirty minutes by that point. Reddit user: [redacted]

That Wasn’t The Option I Was Looking For

I had a woman once who wanted a personal loan so she could buy back a car that we had just repossessed from her that same morning. She didn’t quite seem to grasp the irony in the fact that she was asking for a personal loan from a bank that had just revoked her auto loan. A great plan, right?

I mean, really, though? You didn’t care to pay when there was actual collateral involved, but we’re supposed to believe you’ll pay back an unsecured loan? Needless to say, she was denied. She did pitch an almighty fit, of course. Apparently we were the “bad guys” in the situation for not understanding, and refusing to help her in her “time of need.” Reddit user: [redacted]

It Wasn’t Even Her Idea

I have a great example from when I was working for an insurance company that also offered banking services. This one man had his 401k vested with us. I received a call from him one day that sounded urgent. He was asking if he could come into the office to review the account, and discuss “options”. Okay, no problem. Totally normal for customers to want a financial review once in a while.

A few hours later the guy shows up and lets me know he needs to cash out the entire 401k. That wasn’t what I was expecting. I explained the penalties, and tried to show the benefit of keeping it. I also probed a bit to see if I could offer any other solutions. It was then that he told me he needed the money for an upcoming “brony” convention. I basically said, “Say no more, fam,” and filed the paperwork for him. I’m not ashamed. I’m a brony, too. Reddit user: Sokoke

Going To Vegas

I work at a small bank in Florida. This customer comes in one morning with who we thought was her husband. They sit down and start the process to apply for a personal loan. While they’re going through the motions and answering questions, she mentions the reason she wants the loan in the first place. She wanted it so she can have plastic surgery—face lift, implants, tummy tuck. The works.

They find out that her credit score doesn’t meet the minimum requirements for the loan, so she and the man start to argue. During the argument, it’s revealed that she’s his mistress, and he wanted her to get the loan for the work to be done on her. Man, that was a great day. I love when the crazies come in. I do feel really bad for the lady, though. She was really only doing it because this dude wanted her to. Gross. Reddit user: Ecthios

Not a loan situation, but I worked at a very well-known bank on the East Coast—they were bought out in 2007/2008 by another very big bank from the West Coast during the financial crisis. You can probably guess the banks. Anyway, one morning this regular customer comes up to my spot on the teller line and needs an official check for $100k.

It was our policy to “casually” ask the client what the money was for when they requested an official check over $5k. So, I said something like, “Buying a house?” That was before banks were just like, “We need to know so that we can stop potential fraud.” He looked me dead in the eye, obviously a little irritated that I’d asked, and said, “I’m going to Vegas to gamble, and I’ll probably blow it all.” I told him I hope he wins, wrote the check, signed it, and sent him on his way. It was his money, after all. Reddit user: [redacted]