You Earn Between $48,500 And $145,500

When you hear the term “middle class,” you might assume that the majority of the US population falls into that category. While that may be true, a study from the Pew Research Center suggests that the middle class is shrinking.

Some people in the middle class are proud to be there because it means they’re not poor; others are ashamed and try to pretend that they’re part of the upper class. So what’s the reality, and how do you define “middle class?”

You Act Upper Class

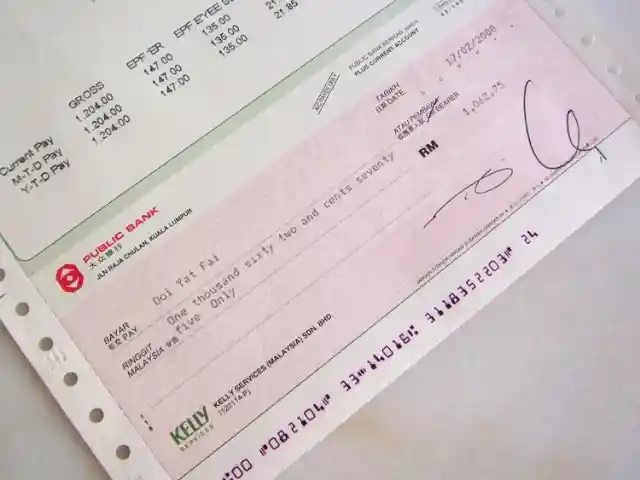

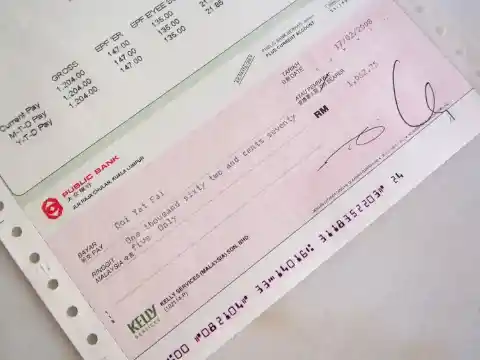

Pew Research Center uses the size-adjusted household income and the cost of living in your area to determine your income tier. Middle-income households are those with an income that is two-thirds to double the US median household income.

That income range was from around $48,500 to $145,500 in 2018. All figures were computed for three-person households, adjusted for the cost of living in a metropolitan area, and expressed in 2018 dollars.

You Wear Designer Brands

A fair share of middle-classers want to drive a brand new car, live in a big house, and wear nice clothes so that they can feel like they’re living a wealthy lifestyle. To them, having a lot of money is the best measure of success.

Some of these people worry about how they’re going to pay their bills in order to maintain their expensive lifestyle. More often than not, actual rich people gain wealth from smart financial decisions and living within their means.

You Have Little To No Emergency Funds

Middle-class people are some of the first to reach for prominent designer name brands. Coach, Micheal Kors, Kate Spade, and Louis Vuitton are just a few of the luxury brands that people are willing to spend a little extra for.

In reality, a lot of rich people don’t tend to wear a lot of flashy designer brands. Preferring to keep a low profile, they usually opt for more conservative apparel when out and about on the town.

You’re Not Saving Enough For Retirement

Even making a decent amount of money, many middle-class folks lead a lifestyle that leaves them living paycheck to paycheck. If something happened where they needed money fast, they’d have to resort to putting the bill on a credit card.

This is a dangerous position to be in, as all it takes is a lost job or one emergency to ruin a person financially. The rule of thumb is to save enough money to pay for three months of expenses in case of a loss of income.

You Could Save If You Tried

Per NPR, middle-class families tend to put around 10% of what they earn toward retirement, including contributions to Social Security. That’s a lot more than the approximately 2.5% that the lower-class sets aside.

It makes sense that middle-class families save more than the poor, but most don’t save enough. According to the Economic Policy Institute, just over 50% of families in the middle-income earners have a retirement account, whereas 88% of the wealthy.

You’ve Got A Side-Hustle

It has already been mentioned that a significant number of middle-classers don’t have enough savings for a rainy day. However, should they cut back on spending, they should be making enough money to save in case of an emergency.

There are plenty of reasons why people struggle to save, from procrastination to student loan debt. While difficult, almost anybody above the poverty line can adjust their lifestyle in order to set money aside for emergencies.

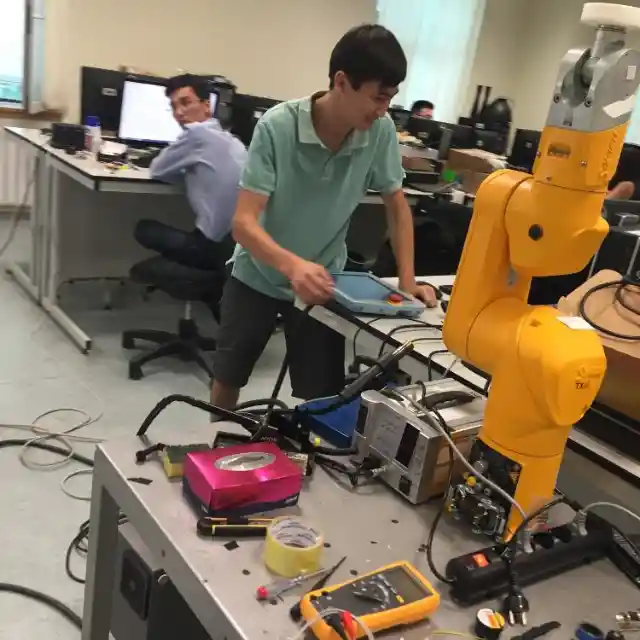

… On Top Of A Secure Job

Thanks in part to technological advances, it’s easier to work a second job now more than ever before, such as driving for Lyft or selling online with Etsy. While some people are proud of their hustle, many suffer from burnout.

Just under 50% of Americans have a side-hustle per Bankrate. Of those who work multiple jobs, three of ten people admit that if it were not for their additional income, they wouldn’t be able to pay the bills.

You’re Climbing The Corporate Ladder

People in the middle class put a lot of effort into their resumes so that they can find a secure full-time job with benefits. Even if they already have a job, they may start to feel uneasy about the strength of a company and interview elsewhere.

Turnover occurs regularly across almost all job types. From a McDonald’s cashier to an accountant to the CEO of a Fortune 500 company, it’s essential to one’s personal well-being to have a regular paycheck coming in.

Your Bills Are Paid On Time

Naturally, those in the middle class usually work for somebody else, while upper-middle-class people tend to be self-employed. The rich, on the other hand, tend to own their own business or businesses.

The people at the top own the corporate ladder that the middle-class people are busy attempting to climb up. The wealthy know they will always need more people working for them in order to make more money.

You Buy All The New Apple Products

According to a survey, 84% of middle-class folks stated they had no problems paying rent, utilities, and all of their other financial responsibilities. Typically, they pay their bills in full as soon as they get a paycheck.

Unfortunately, the same cannot be said for those living closer to the poverty line. They may have go on for months without paying certain bills, and eventually wind up suffer the consequences of late payments.

You’re A Starbucks Regular

Apple has an extremely faithful customer base, many of whom belong to the middle class. Since lower-class people can’t afford to buy a new Macbook and iPhone every year or two, the people constantly upgrading their Apple products are middle class.

Self-made millionaires want to make a great investment, so they may own an Apple product to keep for several years. The whole point of investing in something high-quality is that it’ll last them a long time.

You Believe In The American Dream

There’s a stereotype that Millennials go to Starbucks all the time. Some get offended when they hear it, but most stereotypes have at least some small truth to them – nearly 40 million Americans visit Starbucks at least once per 30 days.

It’s not entirely the fault of the consumer, as Starbucks strategically opens stores only where the demographics show that people make at least $50,000 to $70,000 per year. Conversely, the company tries to stay away from poorer areas.

Your Parents Encouraged A Traditional Path

The American Dream is the ideal by which equal opportunity is available to all, no matter how high one’s aspirations and goals may be. Ever since World War II ended, the media has been trying to push the elusive idea.

Not everybody gets to live that life, of course – that may be why some middle-class people end up having a midlife crisis down the road. Many rich people don’t believe in the American Dream, even if they have all of the things that it entails.

You Have A College Degree And Debt

Most middle-classers have a standard 9-5 job, a decent salary, some vacation time, a health care plan, and even a little money for retirement. All of this happened because their parents likely encouraged them to go down a traditional path.

However, a lot of people who become rich don’t go down that traditional path. They take risks and can’t stand desk jobs – it’s difficult for those who grew up in a comfortable middle-class family to veer off that path.

You Desire To Own A House

College is almost synonymous with debt these days. In past generations, it was possible to pay for a college education while working part-time at a diner, but unfortunately, those days are far in the past.

For those who chose the aforementioned traditional path, it likely means financial difficulties are ahead. Most entry-level jobs after college don’t pay enough to live a comfortable life while also paying off student loans.

Your House Is Your Biggest Asset

Some people who earn a middle-class income are able to buy a house with or without a partner, but it also depends on where they want to live. Other factors keeping people from buying may include student loan debt and high rent.

Middle-class folks don’t view real estate as an investment, rather a place to raise their children. In the past, people in the middle class could even afford a second vacation home, but that’s far less likely to be the case today.

… Or You’re A Renter

If the most valuable asset you have is your home, chances are you’re part of the middle class. An analysis by New York University Economist Edward Wolff found that nearly two-thirds of middle-income households’ total wealth is in their home.

To compare, the top 20% of rich people have less than 30% of their total wealth in their home. Rich people are more likely to have a significant share of their money in stocks, other real estate, or a business.

You Don’t Live In Your Hometown

Home prices are increasing at a disproportionate rate compared to incomes. Without help from families, it’s often extremely difficult to save enough for a down payment while also putting some money toward rent.

People may choose to live with multiple roommates to make rent more affordable. Many young people live at home with their parents far longer than they expected in order to save enough money for future real estate investment.

You Have Streaming Subscriptions

As mentioned previously, some people choose to live at home with their parents after college in order to build up enough money for a down payment on a house. Others choose not to leave the area they grew up in, for whatever reason.

The Federal Reserve found that if you’re 22 or older and live within 10 miles of your childhood home, it’s more likely that you have low income. Those who relocated further away, were more likely to experience higher financial success.

You Love True Crime

Lots of middle-class citizens pay for streaming services such as Netflix, Hulu, YouTube TV, Amazon Prime Video, and Disney+. They often pay for these services instead of going with a traditional cable provider.

The convenience and ability to watch shows across multiple devices is worth the relatively low cost to most people in the middle class. Their time is more valuable than attempting to find high-quality illegal streams online.

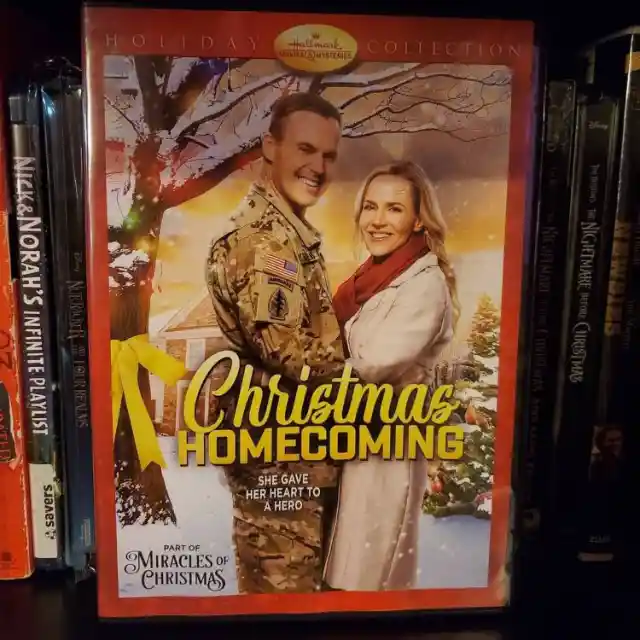

… And Hallmark Christmas Movies

The middle class can’t get enough of true crime, whether they’re getting it from podcasts, TV series or documentaries – shows in this category are at or near the top of the charts. This is in part due to the aforementioned streaming services.

True crime podcasts have really taken off recently, because they’re a great way to hear stories without actually reading a book. They can be played during your commute, which is easier than illegally trying to watch a TV series.

… And Reality TV

In 2019, Hallmark’s viewership grew an additional 9% and totaled 85 million people, and this year they premiered a record-breaking 40 new movies. This shows that not everybody has given up on cable TV just yet.

The idea of escaping from reality through TV has long been popular among the lower and middle classes, but not so much in the upper class. They tend to not watch as much TV in general and may be bored to watch the same plot with different actors.

… And Celebrities

For decades, the family sitcom was super popular among Americans, but that’s been replaced with primetime reality TV series. The Bachelor and America’s Got Talent are some of the top picks among middle-class households.

People in the lower class like watching reality TV, too, but shows like Maury, Jerry Springer, and Judge Judy cater to them. Most of those shows air during the daytime when most people with traditional jobs are working.

You Wear Knock-Off Clothes

Middle-classers tend to look up to those who are rich and famous, so it makes sense that many have an actual obsession with celebrities. Now, it’s easier than ever to stay up to date with the stars through social media.

Those who’re already rich tend not to care nearly as much about the antics of celebrities and famous folks. To them, they’re just another set of people who have made it big doing what they do best.

You Can’t Afford Your Nice Car

We already mentioned that a lot of middle-class people enjoy wearing expensive designer brands, and sometimes, they may resort to buying fake versions of these items. They just want to appear rich enough to buy the brands.

The problem with fake designer clothing is that the items themselves are usually poor quality and don’t last long. Anybody who knows fashion can usually tell in seconds if something looks off or seems inauthentic.

You Want To Keep Up With The Joneses

Vehicles are status symbols and they pressure people into getting nicer cars that they can’t afford. Per a report from The Washington Post, more than 7 million Americans have fallen behind 3 months or more on their car payment.

Public transportation is associated with being poor in many areas of the country. Even when people in the middle class need a ride, they often opt for ride-share apps instead of taking the bus or train home.

You Buy Into Fads

Some people get into debt just to keep up with the appearances of what it means to be middle class. They usually care way too much about what their neighbors think and do, and will go to great measures just to fit in.

For example, if one person gets some solar panels installed on their roof, suddenly all of the neighbors consider doing it, too. Even if they don’t act on the impulse, it’s always in the back of their minds.

You Value Credentials Over Income

Most hot and new products seen on TV are tailor-made for the middle class. From toys to cleaning products to healthcare items, middle-class people have the extra disposable income necessary to buy these types of items, even if they don’t need them.

The lower class usually can’t afford to buy into all of the latest fads that they’d like. The upper class usually recognizes that most of these things are a waste of money, and skips over buying into trends entirely.

You’re Friends With Everybody

Studies show that the middle and upper classes value somebody’s credentials more than the money they earn. For example, if a handyman made $70,000 in a year, he or she made enough to be considered “middle class”, despite being a “working class” job.

On the contrary, somebody with a Ph.D. may struggle to pay his or her bills after making $30,000 in that same year, but still be considered “middle class.” This is because of the high level of education required to earn the distinction.

You Name-Drop

It’s widely accepted that when you surround yourself with successful people, your own success is sure to follow. Likewise, surrounding yourself with unsuccessful people tends to drag you down in the long run.

If you want to earn more, it’s probably best to hang out with people who earn more. Middle-class people tend to hang out with all kinds of people since they can relate to those in both the upper and lower classes to some degree.

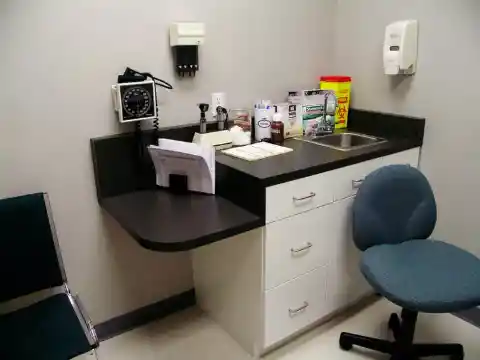

You Have Health Care Concerns

Circling back to celebrity-worship and social media, middle class people always whip out their phones when in the same vicinity as somebody famous. If they score a decent photo or video, it’s immediately uploaded to social media.

Wealthy people tend to name drop far less often. Whether they work with a public figure, understand that these people value their privacy, realize it doesn’t really matter, they don’t associate famous names with success for themselves.

You Have One Or Two Kids

Those who live below the poverty line often qualify for Medicaid, which makes their healthcare free. As soon as you make enough to be considered middle class, you get to worry about monthly premiums, co-pays, deductibles, and medication costs.

As a result, middle-class people are greatly concerned with health care costs – the leading cause of bankruptcy in America is outstanding medical bills. It can ruin your life if you don’t have good medical insurance.

… And You Save For Their College

American women average 2.4 children per Pew Research, and that number has been stable since the 70’s. Although women with less education generally have more kids, average family size has been growing among women who have master’s degrees or Ph.Ds.

Well-educated women may be having more babies as a status symbol since being able to pay for all things associated with children can be quite expensive. Those in the middle class may only be able to afford one or two kids because of all the costs.

You Rarely Live Below Your Means

While most Americans desire to save for their children’s future college education, many find that they can’t. Those who can put some money aside often struggle with saving enough for other everyday essentials.

Saving for college is a primary goal for most middle-class families. A college education can cost anywhere from the low tens of thousands to hundreds of thousands, with the university or college attended having a huge impact on the price.

You Seek Validation On Social Media

Many in the middle class tend to live a lifestyle that teeters on the edge of financial disaster. Even if they get a raise at work, they’d rather marginally upgrade their lifestyle than save more of that newfound money.

Budgeting and saving are great ways to live below your means, but that isn’t the way a lot of middle-class folks choose to live. If they practiced good financial behavior, there would be more money for future investments and fun.

You Have A Midlife Crisis

Social media is a way to interact with others, but it’s also a way for people to measure their own value. Between friends, followers, and likes, it’s hard not to compare your numbers to those around you.

Smart and wealthy people usually don’t need as much social media to feel validated. Unless social media is being used for ulterior marketing purposes, it doesn’t really matter what others think in the long run.

You Earn Vacation Time

Midlife crises usually happen to people when they reach their 40’s or 50’s. They get upset because they realize their life is halfway over and that they’ve usually feel like they wasted the best years of their life.

Some common things that are associated with midlife crises include splurging on a sports car or getting a sudden divorce. Of the people who experience this phenomenon, most of them are firmly in the middle class.

Recessions Hurt You, But It Could Be Worse

Unlike Europeans, Americans get little vacation time. The longer someone works for a company, the more time off they can accrue, but it’s built into the culture that leaving for an extended period of time is frowned upon.

Jobs in retail and restaurants are especially bad for vacation time. Instead of getting paid time off, many companies allow you to call out, but you won’t get paid – by taking a day off, they’re losing the opportunity to earn money.

You’re Emotional With Money

Lower-income earners during the 2008 recession felt the effects more than most. Per the Pew Research Center, low-income people lost around 9% of their earnings on average from 2000 to 2014, while those in the middle-income segment lost just 4%.

Those past losses, combined with declining social mobility, make it likely that many who fit the middle-class description a decade ago are in the same place. In other words, if you were in the middle-class then, you’re likely still in the middle-class.

You Set Easy Goals

According to “How Rich People Think”, there are over 100 differences in how rich and middle class people view money. One of the major differences is that middle-classers have an emotional attachment to money, while the rich see things logically.

Warren Buffett claimed that investing has more to do with controlling your emotions than with money. Emotions cause people to buy high and sell low, and emotions create dangerous business deals – disregard your emotions and use logic instead.

You Work Hard, But Don’t Use Leverage

Those in the middle class set goals, but it’s the capacity of those goals that differ from the middle class to the upper class. Where the middle class person sets safe, obtainable goals, the wealthy set goals that seem difficult, but achievable.

So, in part it’s all about having the right mindset from the get-go. When setting goals, reach out of your comfort zone – in time, it could help you break away from the chains of a middle class lifestyle.

You’re Not A Risk Taker

Hard work is a necessity, but hard work alone rarely leads to great wealth. You can’t become rich doing everything all by yourself; instead, you must use leverage to become rich and keep your assets in tact.

Leverage works in many ways, from investing to outsourcing. The more leverage you incorporate into your life, the more time you’ll have to work on the things that really matter in your business and personal life.

It’s comfortable to work a “safe” job for somebody else. Most middle-classers think being comfortable makes them happy, but the wealthy realize that amazing things can happen when they put themselves in uncomfortable situations.

Those in the middle class aren’t comfortable with being uncomfortable, while the upper class are a little more willing to go out on a limb. Failing is normal and almost necessary to achieve great things.