Maine

Americans seeking a better way of life often vote with their feet. As people relocate, some states and cities come out gainers, while others are even bigger losers. But, when people decide to take that step to find a new home and a better life, where are they going?

Prior to 2020, Americans on the move generally favored the West and the South – leaving the Northeast and Midwest in the rearview mirror. But since the pandemic, the weather has become a secondary variable behind freedom.

Affordable towns in predominantly red states have experienced a population surge, while locked down, higher-crime cities in blue states have seen a mass exodus. With all of this movement however, there have been surprising amounts of population loss in unexpected states. If you’ve been wondering if your neighbors are more likely to be coming or going over the coming year, wonder no more…

Rhode Island

Movers Leaving The State: 50.6%

Maine is a lovely state, but you wouldn’t want to retire there, say the people who are moving out. The majority of them (about 59%) are seniors, ages 65 or older. Nearly four in ten Mainers who leave are headed for retirement elsewhere – probably in a more hospitable climate. “It gets cold during the winter. And windy and snowy,” writes Elsa K., on Quora.

“I’m from northern Iceland and the winters in Maine aren’t as long or dark as in Iceland, but they are colder and snowier,” says another writer on Quora. She adds that the warm-weather months aren’t really any better: “There are bugs. Lots and lots of bugs, especially if you get away from the coast. Ticks, mosquitoes, flies, and things that I don’t know the names of but which want your blood.”

Arkansas

Movers Leaving The State: 49.2%

America’s smallest state by area is having trouble keeping residents within its 1,200 or so square miles. United Van Lines says the reason most people (about 52%) move out is to take a job somewhere else. Hiring has grown in the Ocean State by a ho-hum 1.5% over the last year, according to the U.S. Bureau of Labor Statistics (BLS). Rhode Islanders say good jobs can be hard to come by – and you can’t stay there unless you can find one.

“I love R.I., but it’s expensive,” says a Reddit poster going by mooscaretaker. “Taxes are high and cost of living is high — make sure you have a job prior to moving.” That’s good advice in general, wherever you might be moving. The best job-finding sites match people with curated posts that fit their specific skill-set, so you can be sure you find a good match ahead of time.

Mississippi

Movers Leaving The State: 49.7%

Arkansas is known for its gorgeous parks and wilderness areas, the University of Arkansas Razorbacks sports teams, and its wild weather; Arkansas is located smack in the middle of the U.S. Tornado Alley. It’s also the state that gave us the discount retail giant Walmart and actor Billy Bob Thornton. But the Arkansas job market doesn’t give many people a reason to stay, unfortunately.

71% of those who load their stuff into moving vans say that they’re leaving the state in search of work. In recent years, Arkansas became the first to require Medicaid recipients to hold jobs and thousands lost their health insurance in the months that followed, the Washington Post reported. Critics of the Medicaid move say Arkansas doesn’t have enough work to go around.

Missouri

Movers Leaving The State: 49.4%

Known as the birthplace of the blues, Mississippi offers not only great music but also beautiful Gulf Coast beaches, delicious Southern comfort foods, and the only petrified forest in the Eastern U.S. But what the Magnolia State doesn’t have is an abundance of jobs. Unemployment in the state was among the highest in the nation at about 5.4% in 2019, when the national jobless rate was just 3.5%.

So it may come as no surprise that the main reason Mississippians say “See y’all later” and move out is to go find work. But that’s not the only reason they leave. “It gets REALLY HOT out in the Mississippi Delta,” writes Tom H., on Quora. “There’s tons of mosquitoes and biting flies too. Wonderful folks, terrible conditions. I’d leave right now just to get away from the bugs.”

West Virginia

Movers Leaving The State: 51%

St. Louis might be known as the “Gateway to the West,” but Missourians are frequently inclined to head on through that gateway to another state. No amount of St. Louis’ own Budweiser is proving enough to persuade them to stay. Unfortunately, the Show Me State hasn’t been able to show residents the jobs, which is cited as the #1 reason most movers are choosing to leave.

Factories have been closing around Kansas City, causing that metro area to lose 1.9% of its manufacturing jobs over the past year, the BLS says. A Harley-Davidson motorcycle plant in K.C. shut down in May 2019, putting an estimated 800 people out of work. Missourians commenting on Reddit say the state has other drawbacks, including the weather.

Reddit users make no bones about the weather being wacky, at best. With arctic winters and humid, southern summers, not too many are keen on staying in a climate that rapidly changes from hot to cold with little mild weather in between.

North Dakota

Movers Leaving The State: 51.8%

Mountains and rivers draw visitors to “wild and wonderful” West Virginia, but the economy is driving out residents, especially younger ones. Unemployment is higher than in most other states, and job growth has been sluggish in recent years. More than half the people moving out of the state are aged 44 and younger. 73% of those who leave are headed to jobs elsewhere.

The state’s substance abuse crisis is taking a toll on businesses and their ability to add jobs. A small West Virginia home improvement company is suing several drug-makers because it says its employee health insurance costs are soaring, and they simply can’t afford to maintain coverage. Many former West Virginia residents quip that this isn’t what John Denver meant when he said the state was “almost heaven,” before pointing out that he’d never even been to the state.

Virginia

Movers Leaving The State: 51.3%

One of the most sparsely populated states in the U.S. makes this list because residents simply find it too boring. The most common reason to leave North Dakota – as cited by nearly 61% of those who move out – is the lifestyle. “If you think about it, every state has something interesting about it,” writes one critic, on Quora. “What’s interesting about North Dakota?”

Though some may complain that North Dakota doesn’t offer enough to do, if you live there you will, at least, be able to find a job. The unemployment rate was a minuscule 2.5% in 2019 compared to the national average. And the weather is never dull. In North Dakota, it has gotten as hot as 121 degrees Fahrenheit and as cold as minus 60 – in the very same year (1936).

Wisconsin

Movers Leaving The State: 51.6%

Virginia might not be for lovers so much as it’s for loathers, apparently. More people are moving out than moving in. While the state’s Washington, D.C. suburbs are booming, rural areas in southern and western Virginia are rapidly losing residents, researchers at the University of Virginia’s Weldon Cooper Center for Public Service recently reported. About half of those who depart leave for employment reasons.

A little over a quarter hit the road to move closer to family, and nearly another quarter make an exit because they’d prefer to retire somewhere else. Seniors are the age group most often heading out of state, at 26% of the overall total. All of this is in spite of the fact that Old Dominion is one of the best states for retirees, offering an appealing mix of mountains, beaches, and low taxes.

Movers Leaving The State: 54%

Despite the state’s many charms, many Wisconsinites are packing up their Green Bay Packers cheese-heads and are moving out. The state’s low cost of living and steady, if slow, employment growth remains attractive, but housing prices have been rising rapidly and to record levels, making it difficult to entice many residents to stay and even more difficult to sell many newcomers on moving in.

Another negative is Wisconsin’s long, brutal winters. In the state’s entire recorded weather history, every winter but five hit temperatures of at least 30 below zero, according to data from the National Weather Service. So maybe it’s not so surprising that more than half the people who moved away in 2018 were ages 55 or older and looking to retire to warmer, sunnier climes.

Nebraska

Movers Leaving The State: 52.6%

Mega-rich investor Warren Buffett may famously live in Nebraska – in a house in Omaha that he bought in 1958. But many other people are deciding the Cornhusker State just isn’t for them. A hefty 70% of those who move out of Nebraska are leaving in search of work. The state may have low unemployment, but there’s no bumper crop of jobs. They’re growing at an annual rate of just 0.8%, according to the U.S. Bureau of Labor Statistics.

A 2018 report noted that Nebraska has a “brain drain” because of a lack of high-paying jobs. “We don’t need any more minimum wage, no-experience-required jobs,” says a researcher from the University of Nebraska at Omaha, “we need actual skilled jobs that people can move up into.” Maybe it’s telling that one of Nebraska’s most famous fictional workers – the lead character of the hit TV series Better Call Saul – makes cinnamon rolls at a food court in an Omaha mall.

Maryland

Movers Leaving The State: 53.1%

Maryland may be a treasure trove of history and outdoor adventures, but people don’t seem to want to stay rooted there. The high cost of living, above-average healthcare costs, exorbitant taxes, and soaring home prices are all pushing Marylanders to look elsewhere for jobs and an affordable, comfortable retirement. Half of the people who left in 2018 were 55 and older – which is not surprising when you consider that it’s considered the worst state for retirees.

Anyone planning to hang up their hat in an expensive place like Maryland should talk to a financial adviser and get a jump on their retirement savings. Governor Larry Hogan told WTTG-TV he hoped Maryland’s poor showing in many financial studies would convince the legislature to take action. The governor has proposed cutting taxes in the state by $500 million within the next five years to entice more of their retirement-age residents to stay.

Utah

Movers Leaving The State: 51.7%

Utah has improved its position from a previous study when it ranked no. 9 in terms of people who were moving out. But the state’s breathtakingly beautiful features – including its snow-capped mountains and national parks filled with amazing rock formations – still don’t seem to be enough to persuade many residents to stay. The search for a new job is the primary driving force behind 65% of outbound moves.

Rising housing prices in the Beehive State may also be part of the equation. The median price for an existing single-family home in Salt Lake City has climbed 8% over the past several years to a stiff $358,000, the National Association of Realtors said in a recent quarterly report. That, coupled with an average 6.8% unemployment rate in the first quarter of 2020 is more than enough reason for many residents to buzz off.

Kentucky

Movers Leaving The State: 53.5%

Kentucky is famous for its gorgeous bluegrass landscapes and the thrilling Kentucky Derby, but the lack of good jobs is driving Kentuckians into exile. The state has one of the nation’s highest unemployment rates. And while many of Kentucky’s neighbors – including West Virginia, Ohio, Illinois, and Missouri – have been raising the minimum wage, Kentucky has been stuck at $7.25 an hour for about 10 years.

More than half the people who move out of Kentucky are leaving to take a better job somewhere else. Kentucky officials say the next few years should bring more opportunities in engineering and manufacturing. Plus, jobs are opening up in secondary education, healthcare – and of course, the bourbon industry. So, while Kentucky’s future might look bright, it doesn’t seem to be bright enough (yet) to convince many residents to stay.

Louisiana

Movers Leaving The State: 54.3%

With its unique food and music culture, friendly folks, and nearly endless outdoor activities, Louisiana is a very popular place for tourists to visit. But, a great tourism industry doesn’t necessarily make for a great place to live. Many people are deciding that, while it might be nice to visit, it’s not really somewhere they want to stay in the long term.

Job growth is stagnant in Louisiana, and the taxes can be brutal. The average combined sales tax is the second highest in the U.S. at 9.46%, but employment outside of farms increased by a mere 0.1% from 2018 to 2019. Although the natural gas, methanol, and technology industries are growing in the Pelican State, an overwhelming 70.8% of people who move out are heading to new jobs elsewhere. Some even cite the intense humidity as a major factor in their move.

Montana

Movers Leaving The State: 55%

Montana’s friendly, sociable culture and gorgeous landscapes are attracting A-listers and wealthy out-of-staters to shack up in the mountains – but only on vacation. The state’s once rock-bottom cost of living has gone up. And, though the cost of living is still much lower than other states, housing can be hard to find. When it comes to jobs, here are few work options outside of low-paying seasonal jobs in tourism and the oil industry.

Montana also is far from most of America’s major population centers. The top reason people moved out in 2018 was to be closer to family, followed closely by moving away for better work opportunities. Another problem plaguing the state of Montana is its shortage of healthcare, with just 2.3 doctors per 1,000 residents. Not great odds if you have a medical emergency and need to be seen ASAP.

California

Movers Leaving The State: 54.4%

California’s beach-filled, urban yet outdoorsy lifestyle attracts hardworking professionals and businesses that are ready to hustle. But the state’s astronomical housing prices and high cost of living can kill the dream of leisure faster than just about anywhere else. The top reasons people move out include a lack of well-paying jobs, followed by family issues and more affordable retirement living.

“Unlike a few decades ago, retirees are leaving California, instead choosing other states in the Pacific West and Mountain West,” says Michael Stoll, public policy economist at the University of California, Los Angeles. A CNBC study ranks California last in the nation for business friendliness, and 49th out of the 50 states for cost of living. If you’re thinking of California Dreaming … you might want to think again.

Michigan

Movers Leaving The State: 55%

Despite this state’s glorious parks and nearly 3,300 miles of coastline to explore, nature lovers and others are choosing to pitch their tents someplace other than Michigan. While the state offers job opportunities in computers, math, and management, it’s got vastly more lower-paying work – like food preparation, often paying under $20,000 per year, as reported by Michigan-based Bridge Magazine.

The congressional Joint Economic Committee ranks Michigan as the no. 7 state for “brain drain,” meaning that younger, highly educated workers are fleeing the Wolverine State for better opportunities. About half the people who moved out in 2018 said that the main reason was jobs. Another quarter said more affordable retirement living was the driving factor in their decision to move.

Ohio

Movers Leaving The State: 56.5%

Ohio’s courteous Midwestern spirit is as inviting as its amusement parks, Lake Erie islands, and simple yet innovative cuisine. Yet, while plenty of people are drawn to Ohio from coastal states by the promise of a low cost of living and welcoming communities, even more people are leaving, giving a whole new meaning to the Ohio State Buckeyes’ rallying cry, “Go Bucks!”

This Rust Belt state has been plagued by relatively high unemployment and slow job growth in recent years. Residents frequently complain about the gray, punishing winters and the unbalanced access to good healthcare. But despite the winters and inadequate healthcare, six out of ten Ohioans who move out say they leave for better jobs. Others hit the road for better retirement destinations.

Iowa

Movers Leaving The State: 55.5%

Iowa sunsets over golden cornfields are the stuff of poetry, and its cities and job market are growing. But a staggering three-quarters of those moving away are looking for better employment. In Iowa, even in-demand tech jobs pay less than in other states, and the cost of living in Iowa’s largest cities has risen to levels that many simply can’t afford to sustain.

Aside from the less-than-adequate pay, young Reddit users in Iowa complain about the state’s weather extremes, poorly funded public schools, and crumbling infrastructure. Plus, many say that, “Iowa is a boring state to live in.” By far, the largest group leaving the Hawkeye State is young people ages 18 to 34. They get their degrees from the University of Iowa or Iowa State only to leave for greener pastures.

Massachusetts

Movers Leaving The State: 55.7%

Beautiful, historic Massachusetts is a great place to get an education, see a doctor, and enjoy a wicked fresh lobster roll. Sadly, the insane cost of living in Massachusetts makes it difficult for residents to repay their student loans and also make ends meet. People of all ages are leaving, with the 55-and-over crowd leading the pack in search of milder weather and more affordable living.

More than half of those who head for the exits point to jobs as the main reason they’re moving – often because their company is relocating to a warmer and less expensive state, like Texas or Georgia. Massachusetts’ harsh winters, eye-popping housing costs, and awful traffic congestion (Boston’s is the worst, according to one study), all make good arguments not to stay put in Massachusetts.

Kansas

Movers Leaving The State: 58.7%

There’s no place like home, as Dorothy famously said in The Wizard of Oz. But many Kansas residents are looking for a yellow brick road – or just a plain old asphalt highway – that will simply take them to another state. Despite the Sunflower State’s low-cost, comfy lifestyle and low unemployment rate, nearly 64% of people who move out are leaving for better jobs elsewhere.

The lack of income growth drives experienced, educated workers away, and the state’s windy-with-a-chance-of-tornadoes weather doesn’t help either (Kansas is smack in the middle of Tornado Alley). Sure, Kansas isn’t for everybody – but have you ever seen a sunset over those amber waves of grain? In a word: spectacular. But spectacular sunset views alone just aren’t enough to keep people in the Sunflower State.

Illinois

Movers Leaving The State: 65.9%

The Prairie State has a host of greats within its boundaries: great farm produce, great colleges, great sports, and one of America’s greatest cities: Chicago – home of perhaps the greatest pizza of all (just don’t tell New York). Not so great is the state’s economy. Unemployment is on the high side compared to other states and taxes are among the steepest in the country.

Illinois has the nation’s second-highest property tax rates and a punishing, flat household income tax. As Governor J.B. Pritzker promises to implement a progressive income tax on the state’s wealthiest people, job seekers, adults over 55, and those earning more than $150,000 a year are leading an exodus from Illinois in favor of more tax-friendly states.

New York

Movers Leaving The State: 61.5%

New York State offers a mix of big-city living and small-town culture, including everything from sports to arts, rural wildlife to urban rats capable of stealing a slice of pizza. But life there is no picnic (or pizza party) when you consider the sky-high living costs in the Big Apple, bitterly cold winters up north, taxes that are among the highest in the country, and scarcity of jobs in New York’s rural areas.

Residents starting over in other states are looking for better jobs, a comfy retirement, and a good place to raise the family – with other relatives close by. Close to 300 people move out of New York City every single day, according to a study by Bloomberg. With so many people moving out of NYC daily, you’d think that would leave plenty of well-paying jobs available, but that’s sadly just not the case.

Connecticut

Movers Leaving The State: 62%

Connecticut’s beaches and charming towns attract visitors year-round, but actual residents are leaving faster than the state’s stunning beautiful autumn leaves can fall off the trees. As taxes rise and roads and bridges – and other infrastructure – crumble, Nutmeggers are packing up and saying goodbye. Not to mention crossing their fingers they won’t be encountering too many potholes on the drive out.

People nearing retirement (ages 55 to 64) are the most likely to move out of Connecticut. More than half of those who leave have incomes of $150,000 and up, moving on to find more tax-friendly pastures. “Good riddance,” says one lifelong resident who has no intention of leaving. “Good luck to you,” he writes. “And don’t let the door hit you in the assets on the way out.”

New Jersey

Movers Leaving The State: 66.8%

The Garden State offers beaches, family-friendly suburbs, and lots of football tailgating opportunities – if that’s your thing – because both the New York Giants and the New York Jets play there. But despite all the state has going for it, people are moving out of New Jersey faster than they are from any other state. In fact, New Jersey has been one of the top 10 move-out states for ten years running.

More than a third flee the state because of better-paying job opportunities elsewhere, though an equal share leaves to find greener, cheaper pastures for retirement. Though unemployment is down and wages are going up in New Jersey, the state has a steep cost of living, high taxes, and notoriously bad roads and other infrastructure.

So, now that you know about all of the top states that people are eager to leave, you need to know where they’re moving to – and why – right? When you’re looking for a new place to call home, not only is the job market important, but so is the cost of living, the average home price, and being aware of the average household income.

But, where should you move? Should you discount an entire state, or are there some areas that are still worth staying in or moving to? It’s not always as simple as avoiding an entire state. In fact, while one state might have an overall not-so-great economy, there might be specific metro areas that should still be on your list. Here are a few cities that are worth keeping an eye on…

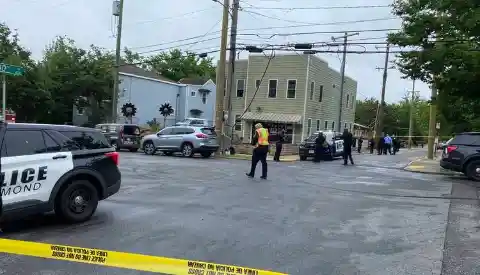

Richmond, Virginia

Median Single-Family Home List Price: $319,950

Median Household Income: $66,191

Despite so many people leaving the state, Virginia’s capital city, Richmond, is still a viable option when looking for a new place to call home. Richmond obviously offers positions in state government, but private companies have loads of jobs there, too. The local unemployment rate recently sank to an 11-year low of 3%, meaning that this part of Virginia, at least, is still for lovers.

The region’s largest private employer is the credit card giant Capital One. Tobacco company Altria Group (maker of Marlboro) is also based there, and so is the used-car retailer CarMax. Richmond’s home prices might be heating up, but they’re still reasonable and affordable, only jumping 7% in 2019. Many banks also have headquarters in Virginia, meaning that lucrative jobs in finance are not hard to come by.

St. Louis, Missouri

Median Single-Family Home List Price: $209,950

Median Household Income: $62,531

In St. Louis, they might want to think about hanging a “Help Wanted” sign on the Gateway Arch. Unemployment in the metro area has dropped to 3.4%, the lowest it’s been in 18 years. The region added nearly 13,000 jobs in 2019, reports the St. Louis Post-Dispatch. Boeing’s St. Louis plant recently signed new contracts to build military aircraft and provide hundreds of new jobs.

While home prices rose 6.7% from spring of 2017 to spring of 2018, they’re still modestly priced. You can buy a 1,200-square-foot condo in a coveted downtown area for about $178,000, or in the suburbs for just $127,000, reports the cost-of-living website Numbeo. If you’re looking for somewhere where you can get a lot of bang for your buck, St. Louis, Missouri isn’t a half bad place to start your search.

Columbus, Ohio

Median Single-Family Home List Price: $249,950

Median Household Income: $63,009

Ohio’s capital city is dominated by Ohio State University (Go Bucks!) and the state government, but they’re not the only games in town for job seekers. The area’s largest private employer is banking powerhouse JPMorgan Chase, with a massive workforce, more than 20,000 strong and growing. Insurance company Nationwide is based there, and so is the nationwide burger chain Wendy’s.

The region’s 3.8% unemployment rate is the lowest in Ohio and skilled jobs abound for those who are well qualified. Columbus even has many charming, historic neighborhoods with gorgeous homes that aren’t crazy-expensive and totally within reach. Including Merion Village, where the average sale price last year was about $268,000, reports Forbes.

Omaha, Nebraska

Median Single-Family Home List Price: $289,050

Median Household Income: $65,490

How do we know Omaha is a great place to live? Warren Buffett – one of the richest men on Earth, who could live anywhere on the planet – has chosen to remain in Omaha, his hometown, despite Nebraska having a fairly high number of residents moving out. Besides Buffett’s Berkshire Hathaway, other Fortune 500 companies based here include Union Pacific (railroad), Kiewit Corp (construction), and Mutual of Omaha (insurance).

Finding a job is no problem in Omaha. The area’s unemployment rate has fallen to just 2.7%. Home prices in the area, on the other hand, have jumped 8.5% in the last year but remain fairly inexpensive compared to other parts of the state. In the suburbs, the average cost of a 2,000-square-foot home is under $275,000.

Sioux Falls, South Dakota

Median Single-Family Home List Price: $234,950

Median Household Income: $65,490

South Dakota’s largest city is getting bigger all the time, thanks to its bustling job market and relatively cheap real estate. Unemployment in fast-growing Sioux Falls has plummeted to an unbelievably low 2.3% and major employers include healthcare providers Sanford Health and Avera Health. Meat processor Smithfield Foods and banking behemoths Wells Fargo and Citibank also have corporate offices in Sioux Falls.

While still very affordable, the area’s home prices have skyrocketed 9.6% in the last year, though. But, with the average home price at right around $235,000, comfortable housing is well within reach for most that choose to live in this bustling region of South Dakota. With its breathtaking scenery and emphasis on the great outdoors, Sioux Falls could be the perfect place for anyone with an adventurous spirit.

Anchorage, Alaska

Median Single-Family Home List Price: $305,050

Median Household Income: $85,266

As Alaska’s biggest city, Anchorage is also its center for industry and jobs. Work is available in healthcare, tourism, government – and, of course, energy (oil and gas). The cost of living is higher in Anchorage than many of the other cities on this list, but salaries are higher, too. The metro area’s 5.4% unemployment rate is relatively high, but down from previous years.

You can buy a three-bedroom house in the suburbs for under $330,000 or a two-bedroom downtown condo for $179,000. Not only does that give you a choice of where you’d like to settle down and establish roots but it also allows you to choose what kind of commute you’d like close to the office or job site.

Des Moines, Iowa

Median Single-Family Home List Price: $292,950

Median Household Income: $67,375

The largest city in Iowa is also its capital, and offers jobs in state government and at Iowa State University, about 30 miles outside of town. But Des Moines’ largest local employer is Wells Fargo, with 14,500 workers alone in the metro area. You’re sure to find good job prospects in Des Moines, as the local unemployment rate has fallen to 2.3% – one of the lowest in the U.S.

Of course, good jobs and low unemployment usually mean a higher cost of living. Housing prices in Des Moines have gone up 7.6% in recent years but are still well within the range of affordability. You can buy a modern one-bedroom loft condo downtown for $185,000, or a brand new three-bedroom house in suburban West Des Moines for about $280,000.

Lafayette-West Lafayette, Indiana

Median Single-Family Home List Price: $200,050

Median Household Income: $54,046

If you know anything about Indiana, you know that Indianapolis is smack in the center of the clock. The Lafayette area is between 10 and 11 o’clock, about 60 miles northwest of Indy. The local unemployment rate is a low 3.4%, and there are plenty of big employers with opportunities, including Purdue University, Subaru, and construction equipment giant Caterpillar.

Housing is easy to come by and very affordable. Brand new buildings in Lafayette are renting one-bedrooms for around $1,399, the local newspapers calling it “unheard of.” A suburban four-bedroom home built in 2010 is priced under $240,000, making the dream of homeownership well within reach for most who choose to move there.

Raleigh, North Carolina

Median Single-Family Home List Price: $347,930

Median Household Income: $70,693

Raleigh, North Carolina is booming – particularly in its highly-sought-after downtown area. New restaurants and nightlife have helped create demand for thousands of new downtown apartments and condos not far from the North Carolina capitol building. A one-bedroom condo downtown rents for about $1,200 a month. Or, you could just buy one in a building with a pool for $245,000.

Better still, for just $307,000, you could buy a five-bedroom house in the suburbs built in 2000. Staffing firm ManpowerGroup recently identified Raleigh as one of the U.S. metro areas with the strongest job prospects in the United States. Unemployment is just 3.5% there and North Carolina is home to several banking giants, including Wells Fargo.

Worcester, Massachusetts

Median Single-Family Home List Price: $311,800

Median Household Income: $71,212

Worcester, pronounced “wooster,” is that city in central Massachusetts with the odd name that isn’t said like it’s written. But more and more people are learning how to say it as the city grows and becomes more of a bedroom community for Boston, about 50 miles away. Worcester’s lower costs are a big attraction, with home prices considerably lower than Boston.

In Worcester, you can buy a three-bedroom home in the suburbs for under $335,000, whereas, in Boston, you’d pay upwards of half a million for the same thing. For those who want to work here, and not commute to the big city, the local unemployment rate recently hit a low of 3.8% and new jobs will be added as the Pawtucket Red Sox minor league baseball team moves to Worcester.

Atlanta, Georgia

Median Single-Family Home List Price: $330,000

Median Household Income: $65,167

“Hotlanta” is now hotter than ever for job opportunities. The local unemployment rate recently fell to a 17-year low of 3.8% and the metro area is home to several Fortune 500 companies. The Home Depot, United Parcel Service (UPS), Coca-Cola, and Delta Air Lines are just a few of the big names you’ll see downtown, plus it’s attracting new tech industry startups all the time due to generous corporate tax breaks.

Young professionals will find plenty to do in the city that hosted the 1996 Summer Olympics. The traffic can be horrible, but Atlanta is far more manageable than, say, New York, Chicago, or LA. It’s a big city, but not humongous, with lots of lush, green areas and parks – you’ll easily be able to see why Atlanta is known as the “Forest City.” If there’s one downside to the ATL, it’s how spaced out the city can seem, with fairly long drives from one area to another and below-average public transportation.

Madison, Wisconsin

Median Single-Family Home List Price: $309,800

Median Household Income: $70,042

Wisconsin’s capital city – and home to the University of Wisconsin – offers jobs for both blue-collar and white-collar workers, alike. Companies based here include Alliant Energy, American Family Insurance, and Spectrum Brands, whose products include Rayovac batteries and the George Foreman Grill. The area also has loads of jobs in the healthcare industry, and more expected to pop up in the coming years.

The city’s unemployment rate was a mere 2.4% in July 2018. But, that’s not the only thing that’s startlingly low. The home prices in Madison are incredible, as well. You can find condos downtown for under $300,000 and three-bedroom homes in the suburbs for less than $270,000, making Madison a top contender for one of the most affordable places to live. It should definitely be on your list if you’re thinking about moving.

Hartford, Connecticut

Median Single-Family Home List Price: $275,000

Median Household Income: $77,980

Younger millennials (think 26 – 30) are flocking to Hartford, and for good reason. Obsolete office buildings are being converted to residential living spaces downtown, creating hip, affordable living spaces for professionals just starting out. But if downtown housing isn’t your thing, no worries. Single-family homes in the suburbs are selling for under $325,000, well within the average household budget.

Hartford is home to major insurance companies, and the industry offers well-paying jobs. The local unemployment rate is only 4.5%, so there are plenty of jobs to go around. Some of the highest paying jobs in Hartford, however, are in the healthcare and mental health fields. Psychiatrists, surgeons, and pediatricians rank as some of the top-paid occupations in the city.

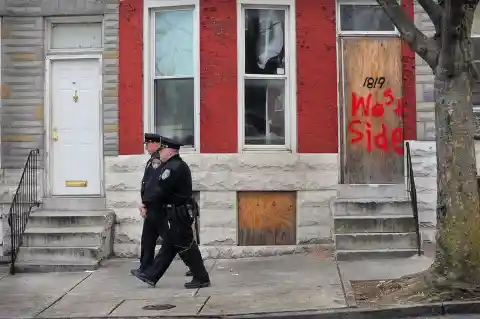

Baltimore, Maryland

Median Single-Family Home List Price: $325,100

Median Household Income: $77,704

Baltimore has been getting back on its feet in the aftermath of the riots in 2015. The downtown and waterfront areas have been given a facelift and are attracting many new residents to the area, particularly to luxury condos in old office buildings that have been converted – a popular choice amongst younger, single job-seekers. Unemployment in the Baltimore area stood at 4.6% in July 2018 and has been trending down ever since.

Conveniently located close to Washington, D.C., Baltimore offers an easy commute to government jobs and homes that are far more affordable than in the nation’s capital or in Arlington and Alexandria, Virginia. Washington’s median home price is much higher, at $449,950, than Maryland’s average list price of only $325,000. This means that, when it comes to finding the perfect place to live, you’ll get a lot more bang for your hard-earned buck.

Philadelphia, Pennsylvania

Median Single-Family Home List Price: $270,000

Median Household Income: $70,516

Philadelphia is in the middle of a huge building boom, with more than eight million square feet of new development being added, according to real estate services firm JLL Philadelphia. Businesses need more space for all the new employees they’re looking to hire. In July of 2018, the Philadelphia metro area had an unemployment rate of only 4.6% and, like many cities, that rate is trending downward.

Along with loads of new office space, townhouses and high-rise condos are going up in the downtown area, all with modest price tags, to accommodate all the new workers expected to migrate to Philly. You might find a one-bedroom condo for under $250,000 in a convenient, downtown location. Plus, the cheese steaks are an added bonus.

Manchester, New Hampshire

Median Single-Family Home List Price: $325,100

Median Household Income: $80,246

One of Manchester’s largest employers is Southern New Hampshire University, which has been on a hiring spree in recent years, adding more than 1,000 professors and administrators to its regular, full-time staff. The city also has job opportunities at a number of budding healthcare startups and also at the Segway Scooter Company, which is based in Manchester.

Manchester boasts an impressively low unemployment rate of 2.6% and is conveniently located less than an hour from Boston – where the median home price is $200,000 more expensive than it is in Manchester, where a comfortable, three-bedroom home in the suburbs will cost you around $325,000 as opposed to the $500,000 you’d likely spend in Boston.

Burlington, Vermont

Median Single-Family Home List Price: $319,100

Median Household Income: $70,227

Burlington, home of the Burlington Coat Factory, is a great place to plant yourself if you’re looking to build your career in a slower-paced city. The region’s unemployment rate of 2.6% is far below the national average. You might find a job with the University of Vermont, or even with Ben & Jerry’s – which offers its ice cream free to employees as a cool (get it?) perk of employment.

Homes in the Burlington area are decently priced, as well, with three-bedroom homes selling for under $350,000. Plus, both Burlington and its suburbs offer walk-able downtown areas, adding to the region’s charm and cost-effectiveness. So, if you’re looking for that cozy, homey New England setting to call your home, Burlington might need to be at the top of your list if you’re considering a move.

Minneapolis, Minnesota

Median Single-Family Home List Price: $344,600

Median Household Income: $76,791

Minneapolis, and neighboring St. Paul, are home to many Fortune 500 companies, including General Mills, Target, and insurance giant UnitedHealth Group. The metro area’s unemployment rate was just 2.6% in July of 2018. Given its wide variety of employers, the area is fast becoming an attractive prospect for talented professionals from larger cities like New York and Chicago.

The Twin Cities have experienced an influx of residents since 2010, which has sparked the construction of new downtown condos and apartment buildings to keep up with the growing housing demands. A single-family home in the suburbs will cost you a respectable $345,000, well within reach of most household budgets.

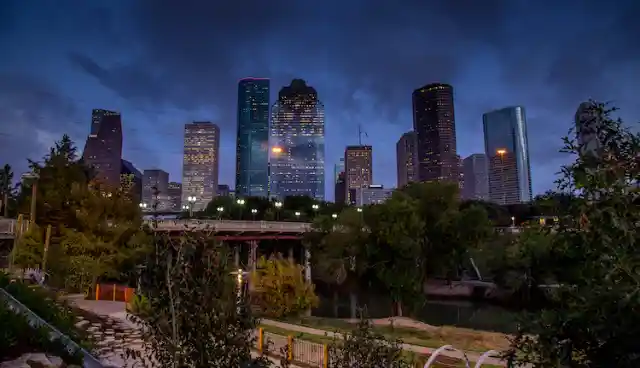

Houston, Texas

Median Single-Family Home List Price: $325,000

Median Household Income: $67,225

Texas’ largest city is a major hub for the energy industry and it’s a great place to live, and find a good job, even if you don’t have a college degree. In July of 2018, the unemployment rate for Houston and its suburbs was 4.4%. Not the best, but with the unemployment rate on a downward spiral, more jobs are expected to open up in the coming years.

In true Texas fashion, homes in Houston are getting bigger and bigger all the time – but, thankfully, the prices don’t seem to be growing with the size of the homes. For instance, you can find a four-bedroom, 3,600-square-foot home for about $350,000 in Houston’s suburbs. So, if Big Sky living is your thing, make sure that Houston is on your list of potential new homes.

Chicago, Illinois

Median Single-Family Home List Price: $299,600

Median Household Income: $69,911

While many might be fleeing Illinois, in general, Chicago remains one of the best metro areas in terms of employment and housing. It might be the nation’s third-biggest metro area, but home prices are far lower than what you find in far larger cities like New York and Los Angeles. With the average home in Chicago’s suburbs going for just under $300,000, the cost of living makes Chicago a no-brainer.

Home to Fortune 500 companies such as McDonald’s, Walgreens, and Boeing, “Chicagoland” attracts workers of all ages and from all over the globe. Decent public transportation makes living in Chicago a lot easier than in many other cities, as well. So, whether you’re commuting to work, hitting the town, or simply going home, you might find that all your destinations are just a few bus or train stops away.

Okay, so you know about plenty of states you might want to avoid, and you even know about some bustling cities that should definitely be on your go-to list. But what about metro areas that you might think about avoiding altogether? If you’ve noticed one thing, it might be that just because one state might be seeing a lot of people leaving doesn’t mean it’s all bad.

On the other hand, just because a state has one, or a few, cities that are worth checking out, doesn’t mean that every metro area is going to be a surefire win when you’re looking for a new place to live. If you live in one of the following cities, it may be time to pack your bags and find someplace better. At least, that’s what your neighbors are thinking…

Baton Rouge, Louisiana

Known for its jazz festivals, fantastic Cajun food and culture, and its family-friendly parks and green spaces, Baton Rouge, Louisiana might not have as much southern charm as it seems at first glance. Despite its lively, inviting culture, the Baton Rouge also has a crime rate that’s said to rival that of Chicago. You might be better off just visiting.

If the relentless, year-round humidity and swarms of ravenous mosquitoes and fire ants don’t drive you out, then the empty and competitive job market just might. As one resident puts it on Reddit, “I moved here 10 years ago. The charm of the area wears off in about six months. I’d recommend literally anywhere else. Send snow and bug spray.”

Little Rock, Arkansas

The state capital of Arkansas, Little Rock is home to museums and libraries, and is an area steeped in civil rights history. Living costs are low, and there are jobs there. In fact, the unemployment rate in September 2018 was just 3.1%. Homes are affordable, too, selling for an average $175,000. So, what’s not to love about Little Rock?

The city has been called one of the most dangerous in America because of its high rates of violent crimes. The region also lies within the central U.S. “Tornado Alley,” and a recent report said more twisters are likely in Little Rock than almost anywhere else in Tornado Alley. So, if you’re looking for somewhere safe, both from crime and weather, Little Rock might not be the place for you.

Chico, California

Not far from Northern California’s historic Camp Fire, Chico is part farming community, part college town – Chico State University has a student body of about 17,000 undergrads. The wildfires may be one reason the Chico metro area makes this part of the list. Other reasons include the area’s surging violent crime rate and its above-average poverty rates.

But, while real estate websites like Redfin say many residents are eager to leave, bidding wars are common for homes here and they’re selling for an average $328,000. With wildfires a common feature and rising crime and poverty rates, it’s easy to see why Chico residents might urge others to consider living somewhere – maybe anywhere – else.

Syracuse, New York

Though Buffalo, New York’s snowfalls are notorious, this city – 150 miles east in upstate New York – takes the award as the snowiest in America. Syracuse gets an average of nearly 124 inches every season. That’s a staggering 10+ feet of snow each year. That could explain why people who live here are inclined to check out houses in other cities where snow shovels aren’t required.

Homes are ridiculously cheap there, though, with the median list price a mere $111,000. And, while the region’s economy has been sluggish, the local unemployment rate recently dropped to an 18-year low of 3.7%. However, local residents say that, unless you’re truly, fully prepared for the frigid, snowy winters (and bosses who might not be too keen on your claiming you can’t get your car out of the snow) you might want to consider living somewhere else.

Omaha, Nebraska

No, you’re not dreaming. Omaha is both one of the best metro areas to move to and also one that local residents aren’t currently loving. While Warren Buffett famously loves Omaha – it’s his hometown, and he has lived in the same modest home there for 60 years – many others living in Nebraska’s largest city don’t seem to share his enthusiasm and dedication.

Many are looking to get out, despite the area’s affordable housing market, with homes listing for a median of $220,000. Unemployment is also a low 2.6%, and the median household income is well above the U.S. average at more than $83,000. So, maybe the big turnoff is Omaha’s extreme weather: Summers are sizzling and winters are frigid, snowy, and long.

Dayton, Ohio

Homes are unbelievably cheap in Dayton, located in Western Ohio, midway between Columbus and Indianapolis. But that doesn’t seem to be enough to keep residents from looking elsewhere. Houses might be selling for an average of only $115,000, but they typically sit on the market for a month and a half, and go for about 3% below the asking price, according to Redfin.

The Dayton metro area has struggled to recover from the Great Recession and the local poverty rate is nearly three times the national average. A recent report from Attom Data Solutions depicted Dayton as a ghost town, with more than 16% of homes vacant. Knowing all of that, it’s easy to see why locals say that Dayton isn’t exactly a great place to live. As one local puts it, “Affordable housing is great, but if you don’t have the jobs to back it up, it’s not worth a whole lot.”

Eugene, Oregon

With its waterfalls and scenic byways, Eugene, Oregon is a truly beautiful place to call home. Unfortunately, living in the area has become an unsustainable dream for many. The cost of housing, whether you rent or own, is incredibly high compared to many of the surrounding states. And with costly housing comes costly property taxes. Couple that with a highly competitive job market, and you have many residents looking to leave.

Those who feel forced to pack their bags are eager to head to Portland or Seattle where the cost of living might not be lower, but there are far better job opportunities. Both Seattle and Portland boast many new jobs in tech and other emerging sectors. Plus, both of those Pacific Northwestern hubs are known for great coffee and great food.

Detroit, Michigan

While Detroit is still Michigan’s biggest metro area by a long mile, the city’s population has been shrinking for decades. In 1950, Detroit was home to over 1.8 million people. But, fast forward about 70 years and that number has dropped to around 673,000 in 2020 and it’s still shrinking at a steady and alarming rate as residents flee in droves.

A booming auto industry made Detroit a great place to live and work, but the industry’s decline hurt the region’s economy. Although some areas of the city are being revitalized and luxury condos are going up, many Detroit area residents are interested in saying goodbye – many moving to Chicago, which, as you’ve seen, isn’t much better. But at least Chicago has jobs.

Salisbury, Maryland

Salisbury, on Maryland’s Eastern Shore, is making a name for itself in the microbrewery scene – but the city’s already got a reputation, just not a very good one. Violent crimes and property crime rates are twice the national average. Public schools are among the worst in the nation, the real estate market is stagnant, and the average household income is low.

Although Salisbury’s unemployment and crime numbers are slowly improving, as good, well-paying jobs are hard to come by, many people have decided the wait just isn’t worth it. They’re moving on to bigger cities like Baltimore or even moving out West where high-paying jobs are easier to find. While many are leaving, dedicated residents are hoping that the new microbrew scene will revive the city and breathe new life into the job market.

Rockford, Illinois

While Rockford offers a ton of amenities and has a relatively low cost of living, unfortunately the good news ends right there. People started moving away in the 1970s, and the trend continues today. The area is a couple of notches above Little Rock on that list of America’s most dangerous cities – being only marginally safer. It lacks decent job opportunities and has notoriously poor public education.

While housing is relatively affordable, many residents say that’s because no one wants to live there. As one longtime resident advises, “Don’t move to Rockford. Choose one of the northern suburbs of Chicago or Madison, Wisconsin, instead. You’d probably even have better luck and be safer in LA … and that’s saying something.” Perhaps this is a warning you should heed when you’re planning your next move.

Orlando, Florida

Orlando is known for offering an amazing array of restaurants, golf courses, year-round sunny weather – and, of course, several world-famous theme parks. But while retirees are happy to move in, younger, longtime residents are on their way out. Orlando’s cost of living is slightly above the national average, but workers earn 22% less than the U.S. average wage, making affordability a real problem.

Meanwhile, Zillow says the median home value of $234,100 is up 10% from last year and is still climbing. Plus, traffic is getting worse, construction is increasing, and displaced wildlife keeps ending up in people’s yards and swimming pools. When you add in subpar public schools, frequent tornadoes, hurricanes, and sinkholes, it’s clear why people are packing it in.

Houston, Texas

No, you’re not just seeing double. Houston also makes the list of places that long-time residents are fleeing. In Houston, unemployment, apartment rent, and housing prices are all above the national average and many residents are feeling the push from local businesses and corporations to either “get in line or get out,” many choosing the latter.

Houston’s infrastructure is so prone to flooding that buying property in the city is considered a less-than-wise investment. Though Hurricane Harvey was big news, the city deals with flooding almost every time there’s a rainstorm and older locals are heading for high ground. These days, many Houstonians are searching for homes in Austin, Dallas, and San Antonio.

Milwaukee, Wisconsin

Metro Milwaukee has been described by some of its own residents as a place of sharp economic contrasts, with rich people who are extremely rich and poor people who are extremely poor. In middle-income and poor neighborhoods, Milwaukee lacks public transportation and decent public schools. These factors make it hard for anyone who doesn’t already have money to live in the area.

Millennials are most affected by these trends and are now looking to Chicago or other cities further west for a place offering a better way of life. Locals say that the job market in Milwaukee is so polarizing. There’s a plethora of high-paid corporate jobs that few qualify for, a boat load of minimum-wage jobs, and barely any middle-of-the-road or entry-level jobs that pay well enough to live on.

Spokane, Washington

Spokane residents enjoy easy access to the Centennial Trail, more than 70 nearby lakes, and numerous local wineries. The local job market also is booming, so at first glance, it seems like a great place to live. But, the city seems to lack the infrastructure to handle more people coming in. Construction can’t keep up with the demand for rentals, condos, and single-family homes in the city.

In response, homes are selling for a whopping 24% more than they were just a year or two ago, and renters are being priced out of the market altogether. Add this to downtown Spokane’s homelessness problem, infrastructure issues, and recent water quality problems, and it’s no wonder hordes of people want to leave, heading for Seattle, Portland, or even Boise, Idaho, where the cost of living is far cheaper.

Chicago, Illinois

While droves of hopefuls are certainly moving to Chicago, a whole lot of Chi-town residents are moving out to make room. They’re most interested in relocating to Phoenix, maybe for the warmer weather. Many people complain about the cost of living, property taxes, education, and lack of amenities in Chicago – although this is a matter of perspective.

New residents hailing from Portland, Oregon or Seattle, Washington might be pleasantly surprised at how affordable things are when compared to what they’re used to. “As they say, one man’s trash is another man’s treasure,” says a local Reddit user. “If someone else can come in and make a good life for themselves, more power to them. I, myself, am ready to move on.”

Denver, Colorado

Housing costs in the Denver metro area are rising faster than people’s wages. More luxury homes are popping up every day, driving up home values across Denver. Redfin says the metro’s median list price for homes has topped $400,000 and is projected to continue climbing in the coming years. While this might seem reasonable for some, long-time Denver natives aren’t so optimistic about it.

Denver residents are looking to migrate to nearby cities like Colorado Springs and Fort Collins, where homes are listed for a median of $305,000. Denverites are searching in Seattle, Washington and even Boise, Idaho as a means of escaping the ever-climbing cost of living and a growing lack of new jobs to keep them employed. “I feel like I have the same skills as lots of newcomers,” says a local factory worker, “but their skills seem to be more valued than mine.”

Washington, DC

Like Chicago, the nation’s capital has plenty of great job opportunities, especially for those who have a bachelor’s degree or are seeking a career in government. But housing costs and property taxes in the D.C. metro area can be shockingly high, and dining out – while a favorable and flavorful experience – tends to be an expensive ordeal for many locals.

So, people in Washington, D.C. and its suburbs are voting with their feet. They’re most inclined to go to Philadelphia to take advantage of that city’s more affordable lifestyle and hot job market. A growing number of D.C. residents are looking further west, to Arizona, Texas, and Washington State to escape the skyrocketing cost of living in the nation’s capital.

Los Angeles, California

Los Angeles residents already contend with a higher-than-average cost of living, high rents, and soaring property taxes – plus, the city’s legendary traffic congestion. Now, with homes starting to sell for an average of $690,000, many residents are getting priced out, despite the fact that these homes go quickly, typically spending less than a month on the market, Redfin says.

Today, burned-out L.A. locals, who are tired of waiting for their big Hollywood break while still paying Hollywood prices, are looking to head to more reasonable San Diego and Sacramento, California. Some are even looking in other states, entirely. Arizona, Nevada, Washington, and Idaho are seeing an influx of new residents from California looking for a more affordable life.

New York, New York

It may come as no real surprise that New York City is among the most expensive metro areas in the world, and competition is stiff in practically every job sector. Given the high cost of food and housing, the population in New York City is – understandably – somewhat transient. According to the U.S. Census data, almost 300,000 New Yorkers move to the suburbs each year, opting to commute into the city for work.

On top of the 300,000 that move out of the city, another 200,000 relocate out of state. Their main motivation in leaving is to buy a home and gain more space. But maybe it’s at least a little surprising that the metro area they most want to flee to is Boston – which isn’t exactly cheaper or more spacious.

San Francisco, California

San Francisco’s high-paying jobs attract plenty of people year after year, but it’s insanely expensive real estate pieces just drive them all away again. Homes that would be undesirable elsewhere sell for hundreds of thousands over asking price in desperate bidding wars for limited space – especially in the Bay Area, where the average selling price is currently about $1.4 million.

Residents making San Francisco the most-fled metro area are seeking relief in the marginally more affordable West Coast markets of Sacramento and even LA. Many more are beginning to seek more cost-effective living in surrounding Western states like Nevada, Washington, and Idaho while others look even farther, to the opposite side of the country, towards Atlanta, Georgia and Charlotte, North Carolina.